Featured

Table of Contents

Juvenile insurance policy gives a minimum of security and could offer coverage, which could not be offered at a later day. Amounts given under such protection are normally minimal based on the age of the youngster. The current constraints for minors under the age of 14.5 would be the better of $50,000 or 50% of the amount of life insurance policy in force upon the life of the applicant.

Adolescent insurance coverage may be sold with a payor benefit biker, which offers forgoing future costs on the child's policy in case of the death of the individual that pays the costs. Senior life insurance policy, often referred to as rated fatality advantage strategies, gives eligible older applicants with very little whole life coverage without a medical exam.

The permitted issue ages for this kind of insurance coverage variety from ages 50 75. The maximum issue quantity of coverage is $25,000. These plans are generally much more pricey than a fully underwritten policy if the individual qualifies as a basic danger. This type of insurance coverage is for a tiny face quantity, generally purchased to pay the funeral costs of the insured.

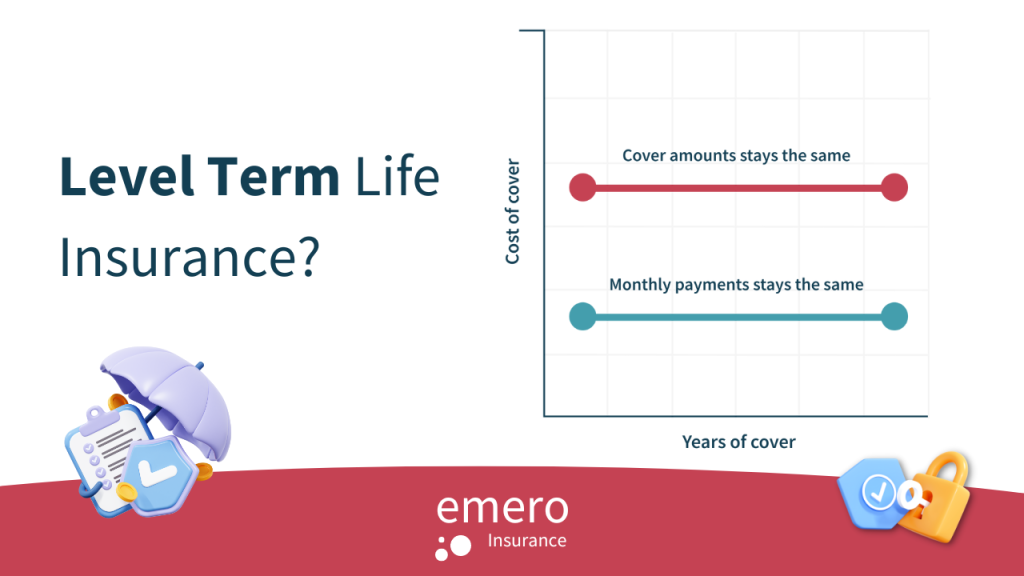

Our term life options consist of 10, 15, 20, 25, 30, 35, and 40-year policies. The most preferred kind is level term, suggesting your payment (costs) and payment (survivor benefit) remains level, or the same, until the end of the term duration. This is one of the most straightforward of life insurance policy choices and requires very little maintenance for policy proprietors.

Level Term Life Insurance For Families

You can give 50% to your partner and split the rest among your adult children, a moms and dad, a buddy, or also a charity. Level term life insurance benefits. * In some circumstances the survivor benefit might not be tax-free, discover when life insurance policy is taxable

1Term life insurance supplies temporary defense for an essential duration of time and is usually less costly than long-term life insurance. 2Term conversion guidelines and constraints, such as timing, may apply; as an example, there may be a ten-year conversion advantage for some products and a five-year conversion advantage for others.

3Rider Insured's Paid-Up Insurance policy Acquisition Option in New York. There is an expense to exercise this rider. Not all getting involved plan owners are eligible for rewards.

Level Term Life Insurance For Young Adults

We may be compensated if you click this advertisement. Ad Level term life insurance policy is a policy that provides the exact same fatality benefit at any kind of point in the term. Whether you die on the very same day you take out a plan or the last, your recipients will obtain the same payment.

Policies can likewise last up until defined ages, which in the majority of instances are 65. Beyond this surface-level details, having a higher understanding of what these strategies involve will help ensure you acquire a plan that satisfies your requirements.

Be conscious that the term you choose will influence the premiums you spend for the plan. A 10-year degree term life insurance plan will cost much less than a 30-year plan since there's less chance of an occurrence while the plan is active. Lower risk for the insurance firm equates to decrease costs for the insurance policy holder.

How do I choose the right 30-year Level Term Life Insurance?

Your family's age need to likewise affect your plan term selection. If you have little ones, a longer term makes feeling because it secures them for a longer time. If your youngsters are near their adult years and will be monetarily independent in the close to future, a shorter term may be a far better fit for you than a prolonged one.

Nonetheless, when comparing entire life insurance policy vs. term life insurance, it's worth noting that the last normally expenses much less than the former. The result is much more protection with reduced costs, offering the very best of both worlds if you require a substantial amount of protection however can't pay for a much more pricey plan.

Where can I find Level Term Life Insurance For Seniors?

A degree death benefit for a term policy generally pays out as a swelling amount. Some level term life insurance coverage companies enable fixed-period payments.

Rate of interest repayments received from life insurance coverage plans are considered revenue and are subject to taxation. When your level term life policy runs out, a few different points can happen.

The disadvantage is that your renewable degree term life insurance will certainly come with greater costs after its first expiry. We might be compensated if you click this ad.

How do I choose the right Low Cost Level Term Life Insurance?

Life insurance firms have a formula for computing threat making use of mortality and passion. Insurance firms have thousands of customers securing term life plans at as soon as and use the premiums from its active plans to pay surviving beneficiaries of other policies. These firms utilize mortality to estimate the amount of individuals within a particular team will certainly file fatality insurance claims annually, and that information is made use of to identify ordinary life expectations for potential policyholders.

Furthermore, insurance provider can spend the money they get from costs and raise their income. Given that a degree term policy does not have cash money value, as a policyholder, you can't invest these funds and they don't give retirement revenue for you as they can with whole life insurance policy policies. Nonetheless, the insurance coverage business can invest the cash and make returns.

The complying with section information the pros and disadvantages of degree term life insurance policy. Foreseeable premiums and life insurance protection Simplified policy framework Prospective for conversion to long-term life insurance policy Minimal insurance coverage period No cash worth accumulation Life insurance policy costs can enhance after the term You'll discover clear benefits when contrasting degree term life insurance to various other insurance policy kinds.

What should I know before getting Level Term Life Insurance For Young Adults?

You always understand what to anticipate with affordable degree term life insurance policy coverage. From the moment you secure a policy, your premiums will never ever alter, aiding you plan financially. Your coverage won't differ either, making these policies reliable for estate planning. If you value predictability of your settlements and the payments your successors will certainly get, this type of insurance can be an excellent fit for you.

If you go this path, your costs will certainly increase yet it's always great to have some adaptability if you want to keep an active life insurance plan. Sustainable degree term life insurance coverage is another alternative worth considering. These policies permit you to keep your present plan after expiry, giving versatility in the future.

Latest Posts

Burial Insurance Vs Life Insurance

Life Insurance Instant Coverage

Texas Burial Insurance