Featured

Table of Contents

- – What is Level Term Life Insurance Policy? Deta...

- – Is What Is Direct Term Life Insurance a Good O...

- – All About Level Premium Term Life Insurance C...

- – What You Should Know About Joint Term Life In...

- – What is Voluntary Term Life Insurance? Compr...

- – How Does Term Life Insurance Level Term Comp...

If George is identified with a terminal disease throughout the very first policy term, he probably will not be qualified to restore the plan when it runs out. Some plans offer assured re-insurability (without proof of insurability), but such attributes come with a greater expense. There are a number of sorts of term life insurance coverage.

Most term life insurance coverage has a degree premium, and it's the type we have actually been referring to in most of this write-up.

Term life insurance policy is attractive to young individuals with children. Moms and dads can obtain substantial insurance coverage for an affordable, and if the insured dies while the plan holds, the household can count on the survivor benefit to change lost income. These plans are also appropriate for people with expanding households.

What is Level Term Life Insurance Policy? Detailed Insights?

Term life plans are perfect for individuals that desire substantial protection at a low price. Individuals who own whole life insurance policy pay a lot more in costs for much less protection yet have the safety and security of knowing they are shielded for life.

The conversion rider need to enable you to transform to any kind of long-term policy the insurer uses without restrictions. The key attributes of the rider are keeping the initial wellness ranking of the term plan upon conversion (also if you later on have wellness issues or become uninsurable) and determining when and just how much of the insurance coverage to transform.

Of training course, total premiums will raise substantially since whole life insurance coverage is a lot more pricey than term life insurance coverage. Clinical conditions that develop throughout the term life period can not create premiums to be increased.

Is What Is Direct Term Life Insurance a Good Option for You?

Whole life insurance comes with substantially greater regular monthly premiums. It is indicated to give coverage for as long as you live.

It depends on their age. Insurance provider established an optimum age restriction for term life insurance plans. This is generally 80 to 90 years old but may be greater or reduced depending on the firm. The premium also increases with age, so a person aged 60 or 70 will pay considerably even more than a person decades more youthful.

Term life is rather comparable to auto insurance policy. It's statistically unlikely that you'll require it, and the costs are cash down the tubes if you do not. If the worst takes place, your family will receive the benefits.

All About Level Premium Term Life Insurance Coverage

Essentially, there are 2 kinds of life insurance policy plans - either term or irreversible strategies or some combination of both. Life insurance companies offer different forms of term plans and traditional life policies along with "rate of interest sensitive" products which have ended up being extra common given that the 1980's.

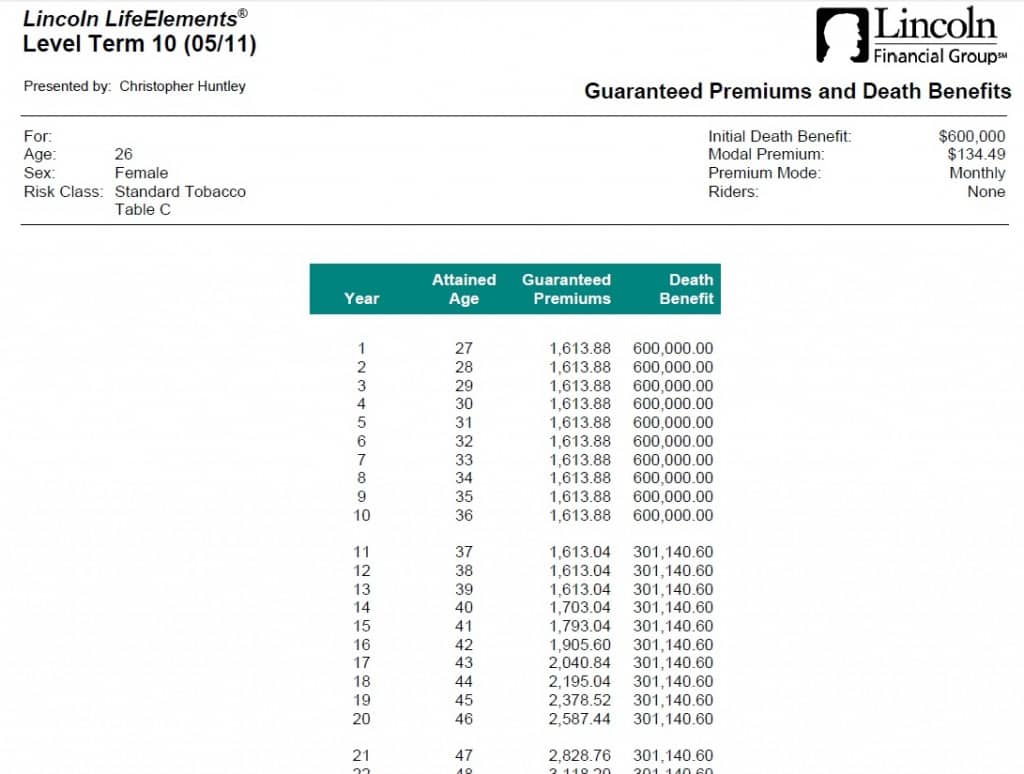

Term insurance coverage gives defense for a specified amount of time. This duration might be as short as one year or give protection for a certain variety of years such as 5, 10, twenty years or to a defined age such as 80 or sometimes approximately the earliest age in the life insurance policy mortality.

What You Should Know About Joint Term Life Insurance

Currently term insurance policy rates are very affordable and amongst the least expensive historically experienced. It needs to be noted that it is an extensively held idea that term insurance policy is the least pricey pure life insurance policy coverage available. One requires to examine the policy terms carefully to choose which term life alternatives appropriate to satisfy your certain scenarios.

With each brand-new term the premium is boosted. The right to renew the plan without proof of insurability is an essential advantage to you. Or else, the danger you take is that your health might wear away and you may be not able to get a policy at the very same rates or even in all, leaving you and your recipients without coverage.

The length of the conversion duration will certainly vary depending on the kind of term plan purchased. The costs rate you pay on conversion is generally based on your "present acquired age", which is your age on the conversion date.

Under a degree term policy the face amount of the plan continues to be the same for the whole duration. Usually such policies are offered as mortgage protection with the amount of insurance lowering as the equilibrium of the mortgage decreases.

Commonly, insurance firms have not had the right to change premiums after the plan is marketed. Because such plans may proceed for years, insurance providers must use traditional death, rate of interest and expenditure rate price quotes in the premium estimation. Adjustable premium insurance, however, permits insurance companies to provide insurance coverage at lower "current" premiums based upon less conservative assumptions with the right to alter these premiums in the future.

What is Voluntary Term Life Insurance? Comprehensive Guide

While term insurance coverage is created to supply security for a specified period, permanent insurance policy is created to supply coverage for your whole lifetime. To keep the premium price level, the costs at the more youthful ages surpasses the real cost of defense. This added premium constructs a book (cash value) which aids pay for the policy in later years as the price of security increases over the costs.

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations (whole life insurance for infinite banking brokers specialize in). Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow.

The insurance policy firm invests the excess costs dollars This type of plan, which is occasionally called cash worth life insurance, creates a cost savings aspect. Money worths are critical to a long-term life insurance coverage policy.

Sometimes, there is no correlation in between the dimension of the money value and the premiums paid. It is the money value of the plan that can be accessed while the insurance holder lives. The Commissioners 1980 Criterion Ordinary Death Table (CSO) is the present table utilized in calculating minimal nonforfeiture values and plan reserves for average life insurance policy policies.

How Does Term Life Insurance Level Term Compare to Other Policies?

Many permanent policies will certainly include stipulations, which define these tax requirements. There are 2 fundamental classifications of long-term insurance policy, typical and interest-sensitive, each with a variety of variants. Furthermore, each category is typically available in either fixed-dollar or variable kind. Traditional entire life policies are based upon long-lasting estimates of expense, passion and mortality.

Table of Contents

- – What is Level Term Life Insurance Policy? Deta...

- – Is What Is Direct Term Life Insurance a Good O...

- – All About Level Premium Term Life Insurance C...

- – What You Should Know About Joint Term Life In...

- – What is Voluntary Term Life Insurance? Compr...

- – How Does Term Life Insurance Level Term Comp...

Latest Posts

Burial Insurance Vs Life Insurance

Life Insurance Instant Coverage

Texas Burial Insurance

More

Latest Posts

Burial Insurance Vs Life Insurance

Life Insurance Instant Coverage

Texas Burial Insurance