Featured

Table of Contents

Life insurance coverage provides five monetary advantages for you and your family. The main benefit of adding life insurance policy to your financial strategy is that if you pass away, your successors obtain a round figure, tax-free payment from the policy. They can utilize this money to pay your final costs and to replace your earnings.

.jpg)

Some policies pay out if you create a chronic/terminal illness and some supply cost savings you can use to support your retirement. In this write-up, learn more about the various advantages of life insurance coverage and why it might be a good concept to purchase it. Life insurance coverage supplies benefits while you're still alive and when you pass away.

What is Term Life Insurance?

Life insurance policy payments usually are income-tax free. Some permanent life insurance coverage plans construct cash worth, which is cash you can get while still alive. Life insurance policy can also pay if you establish a significant illness or go into an assisted living home. The national mean cost of a funeral that includes a funeral service and a burial was $7,848 since 2021.

If you have a plan (or policies) of that dimension, the people that depend upon your income will certainly still have money to cover their ongoing living expenses. Beneficiaries can use plan advantages to cover essential day-to-day expenditures like rent or mortgage repayments, utility bills, and grocery stores. Ordinary yearly expenditures for houses in 2022 were $72,967, according to the Bureau of Labor Data.

Life insurance payments aren't taken into consideration income for tax purposes, and your recipients do not have to report the cash when they file their tax returns. Depending on your state's regulations, life insurance policy advantages may be used to offset some or all of owed estate tax obligations.

Growth is not affected by market problems, permitting the funds to accumulate at a steady price in time. In addition, the cash value of entire life insurance policy expands tax-deferred. This implies there are no revenue tax obligations accrued on the money worth (or its growth) until it is taken out. As the cash money worth builds up over time, you can utilize it to cover costs, such as purchasing an automobile or making a deposit on a home.

How much does Death Benefits cost?

If you decide to obtain against your money worth, the financing is not subject to earnings tax obligation as long as the plan is not surrendered. The insurer, nevertheless, will certainly charge passion on the financing amount up until you pay it back. Insurer have differing rate of interest on these car loans.

8 out of 10 Millennials overstated the price of life insurance coverage in a 2022 study. In actuality, the average price is better to $200 a year. If you believe purchasing life insurance policy might be a clever financial step for you and your household, consider seeking advice from with an economic consultant to embrace it into your financial strategy.

Why is Life Insurance Plans important?

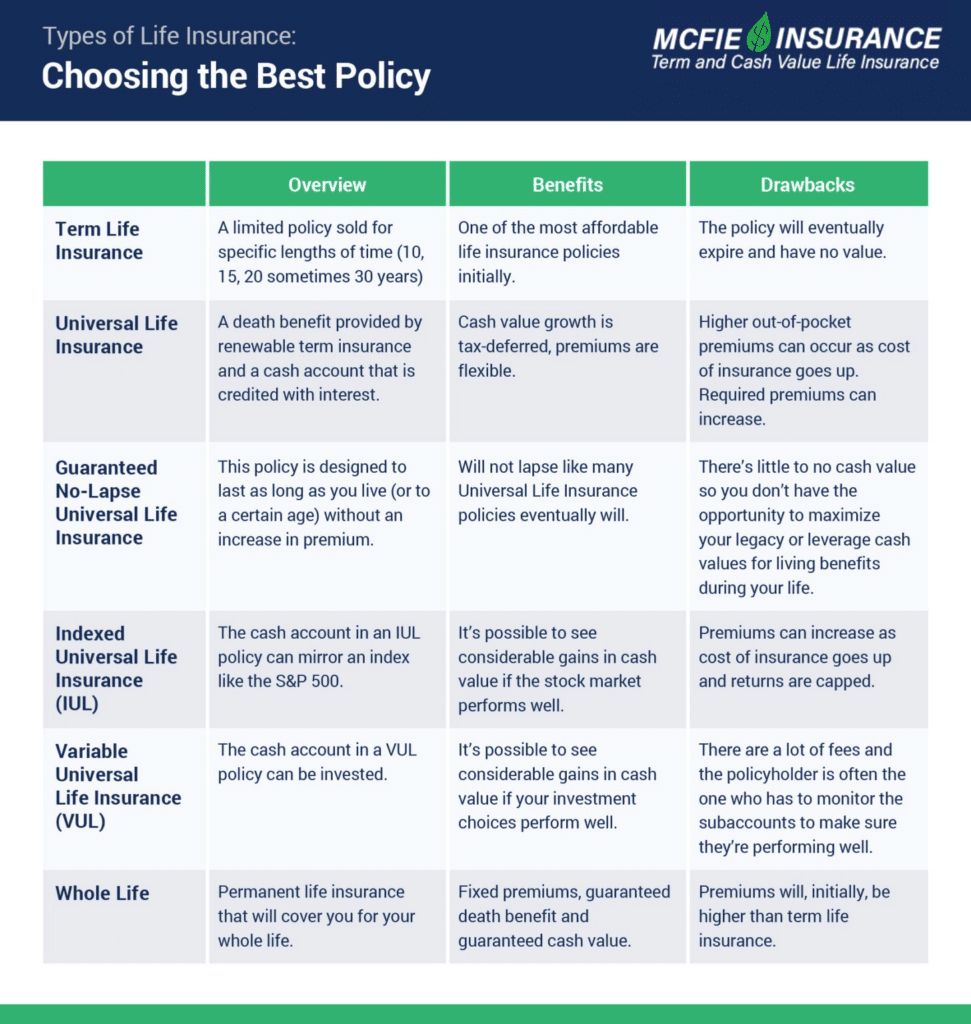

The five main types of life insurance policy are term life, entire life, global life, variable life, and last expenditure coverage, likewise understood as interment insurance. Whole life begins out setting you back much more, but can last your entire life if you keep paying the costs.

Life insurance coverage could likewise cover your home mortgage and provide money for your family to keep paying their expenses. If you have household depending on your revenue, you likely require life insurance to sustain them after you pass away.

Lesser amounts are offered in increments of $10,000. Under this strategy, the elected insurance coverage takes result two years after enrollment as long as premiums are paid during the two-year duration.

Insurance coverage can be extended for as much as two years if the Servicemember is completely disabled at splitting up. SGLI insurance coverage is automated for most active service Servicemembers, Ready Get and National Guard participants arranged to execute a minimum of 12 periods of inactive training per year, participants of the Commissioned Corps of the National Oceanic and Atmospheric Management and the general public Health Solution, cadets and midshipmen of the united state

How do I choose the right Life Insurance?

VMLI is readily available to Experts that received a Specifically Adapted Housing Give (SAH), have title to the home, and have a home loan on the home. near to new registration after December 31, 2022. We started accepting applications for VALife on January 1, 2023. SGLI protection is automated. All Servicemembers with permanent protection need to make use of the SGLI Online Registration System (SOES) to assign recipients, or reduce, decrease or recover SGLI coverage.

All Servicemembers should make use of SOES to decline, reduce, or recover FSGLI protection.

What types of Death Benefits are available?

Policy benefits are reduced by any type of exceptional loan or financing interest and/or withdrawals. Returns, if any kind of, are influenced by plan finances and car loan passion. Withdrawals over the cost basis may result in taxed regular revenue. If the plan gaps, or is surrendered, any superior loans considered gain in the plan may undergo normal earnings taxes.

If the plan proprietor is under 59, any taxed withdrawal might likewise be subject to a 10% federal tax obligation charge. All whole life insurance plan assurances are subject to the prompt settlement of all needed costs and the claims paying capacity of the issuing insurance company.

The money surrender value, funding value and death earnings payable will be minimized by any type of lien impressive because of the settlement of a sped up benefit under this biker. The sped up advantages in the first year reflect deduction of a single $250 administrative charge, indexed at a rising cost of living rate of 3% per year to the rate of acceleration.

A Waiver of Costs cyclist waives the obligation for the insurance holder to pay additional costs ought to he or she end up being totally impaired constantly for a minimum of 6 months. This motorcyclist will certainly incur an added price. See policy agreement for added details and requirements.

Who provides the best Life Insurance?

Find out more regarding when to get life insurance policy. A 10-year term life insurance coverage policy from eFinancial prices $2025 monthly for a healthy grownup who's 2040 years of ages. * Term life insurance is extra inexpensive than permanent life insurance policy, and female consumers generally obtain a reduced rate than male customers of the same age and wellness condition.

Latest Posts

Burial Insurance Vs Life Insurance

Life Insurance Instant Coverage

Texas Burial Insurance